Supply chain status update and the impact of 5G

Live broadcast online

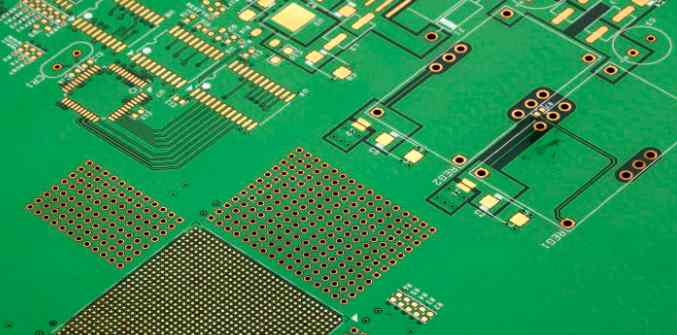

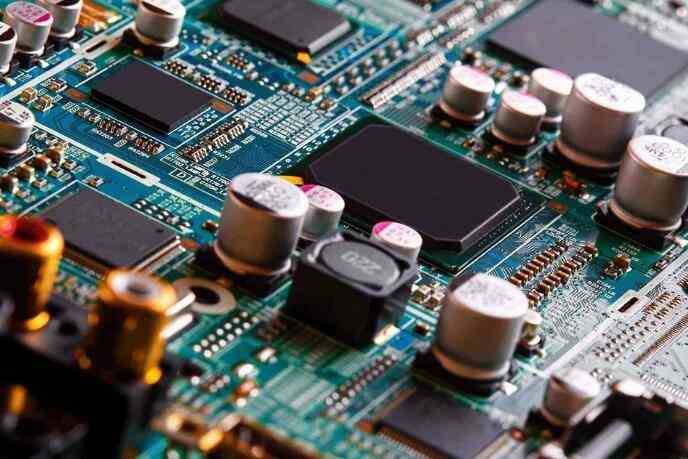

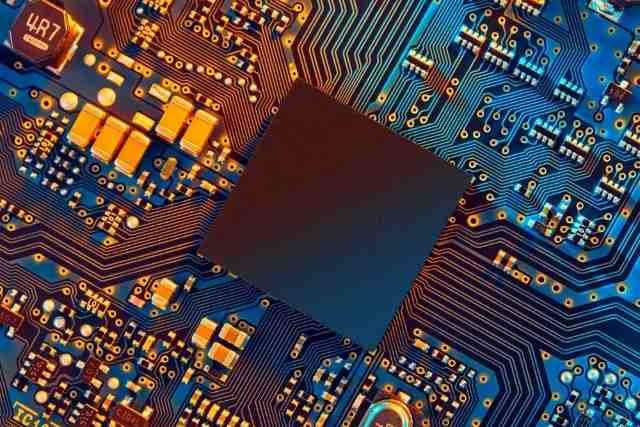

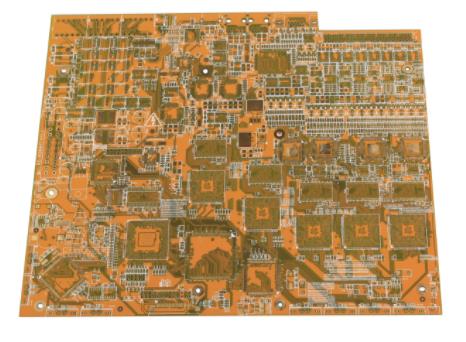

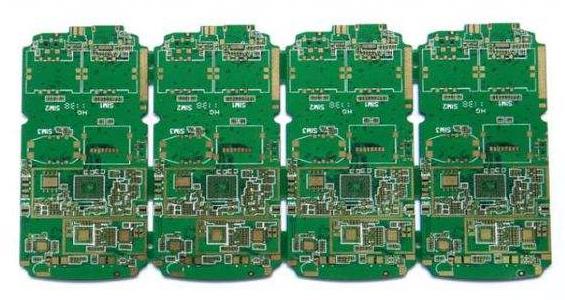

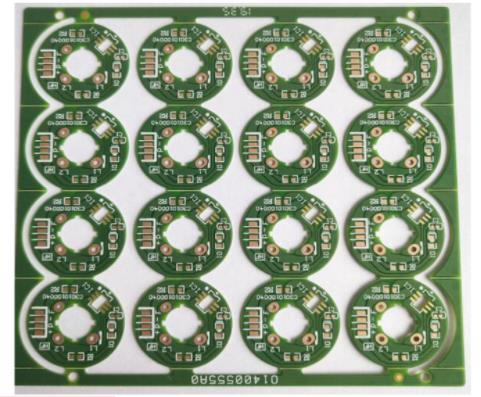

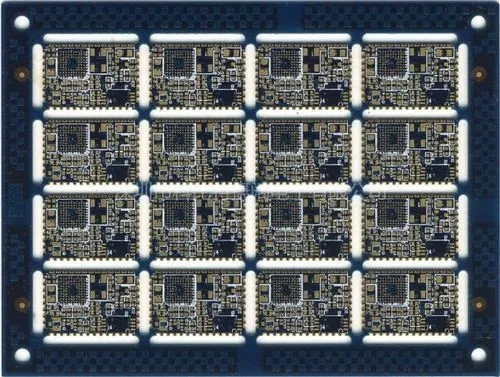

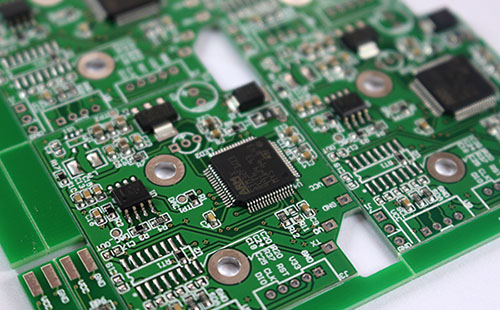

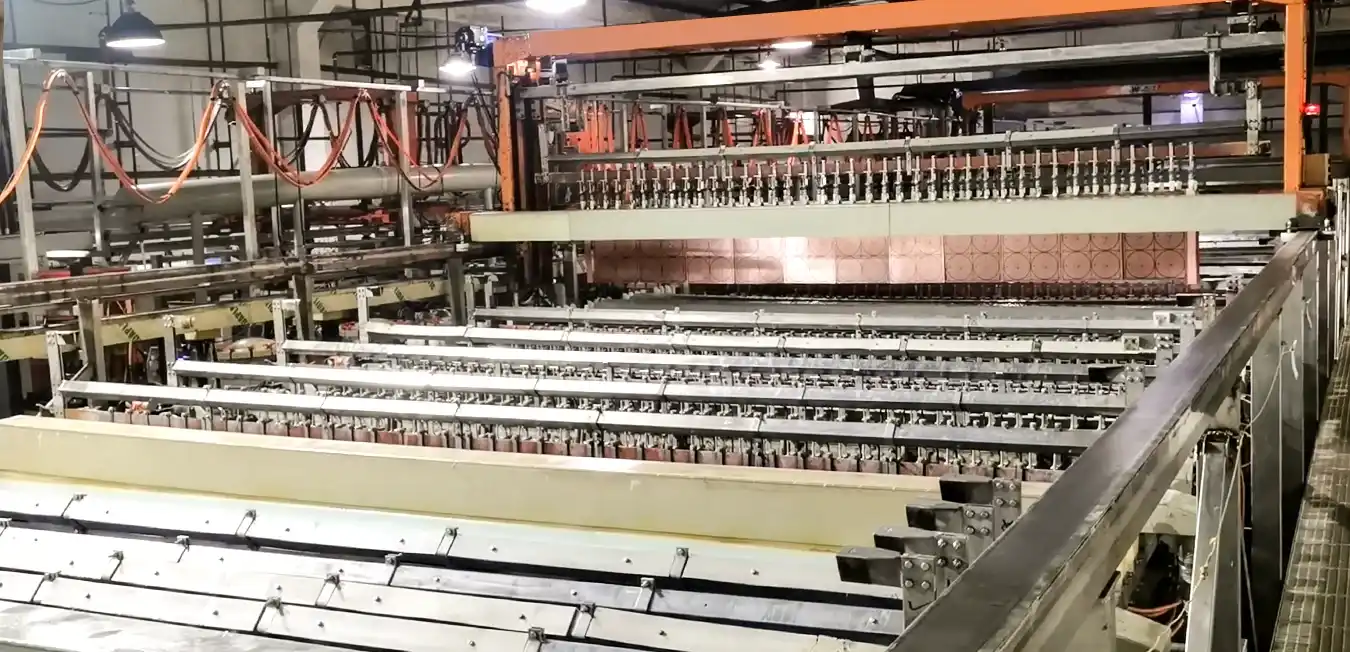

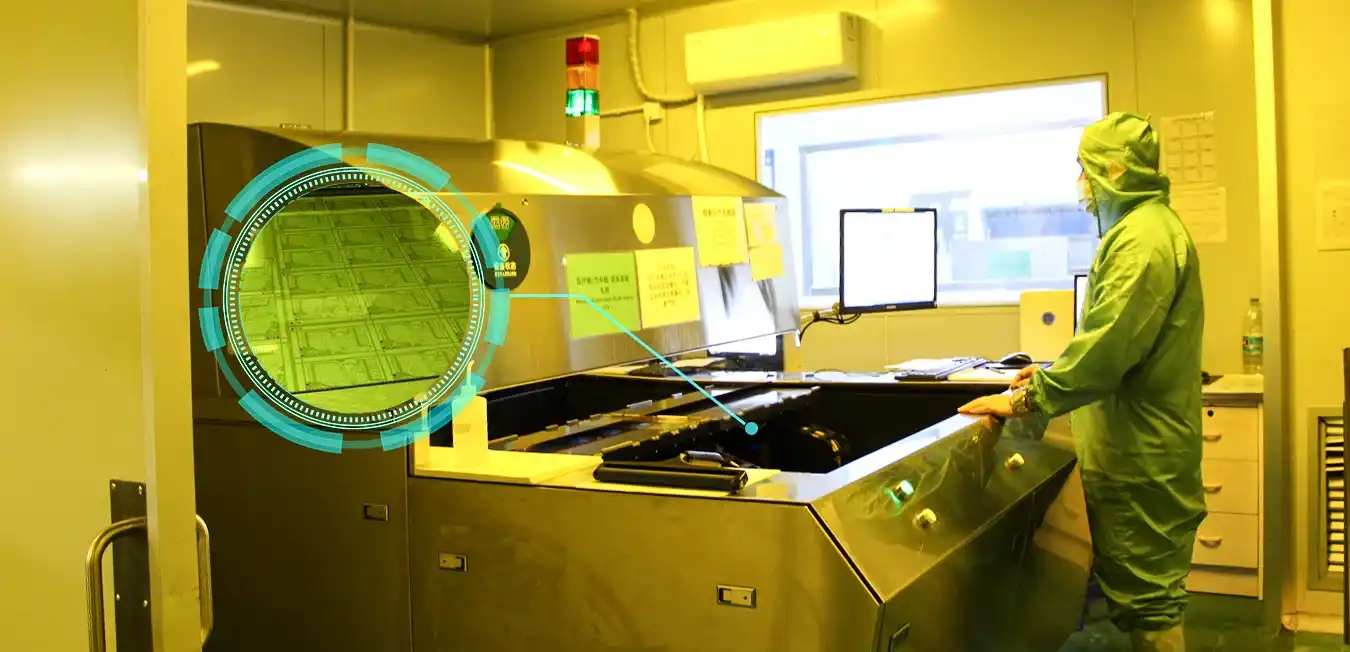

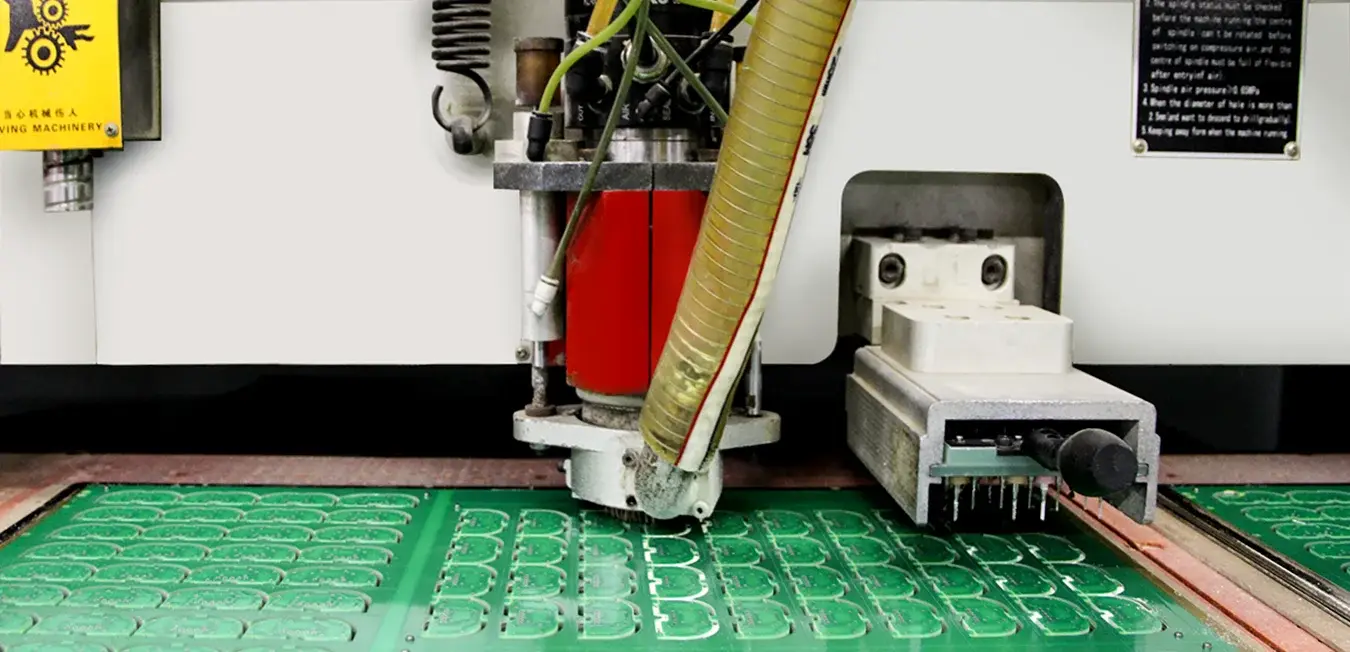

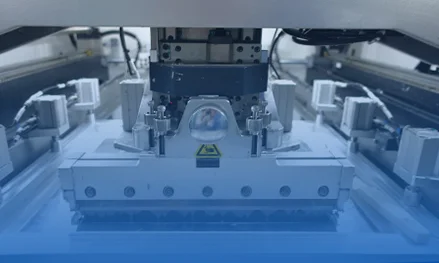

Kingford has its own 5000 square meters workshop, and is equipped with laser marking machine board, laser cutting machine,

CNC drilling machine, PCB laminating machine, PCB silk screen printing, PCB CNC machine tool, automatic PCB tester,

PCB two-dimensional inspection, PCB flying Needle tester and other equipment, is committed to building a first-class

production line, escorting the price of PCB quality.

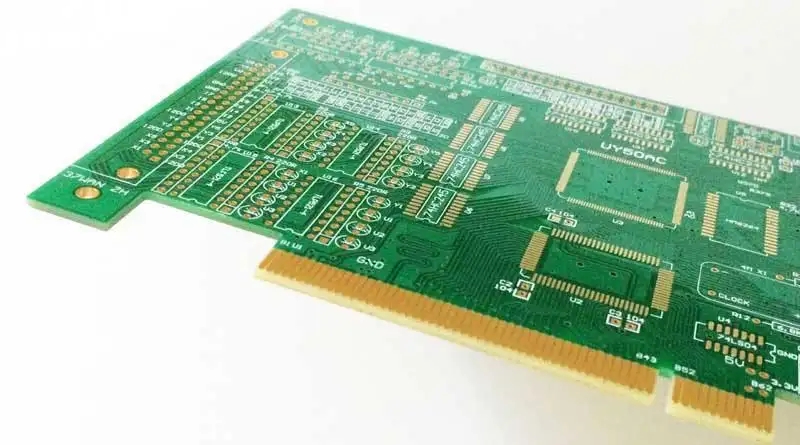

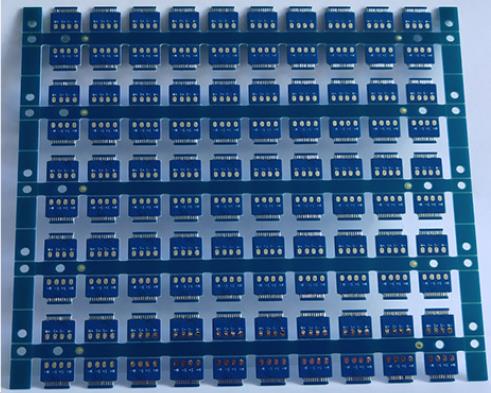

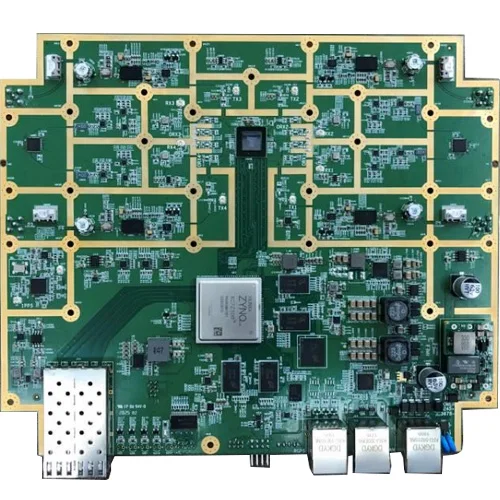

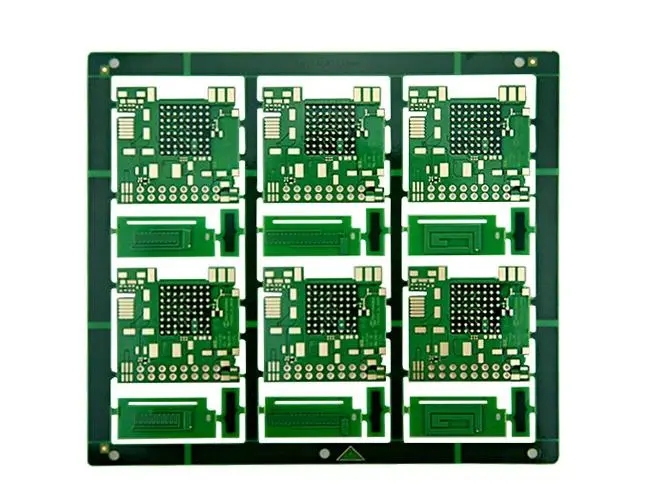

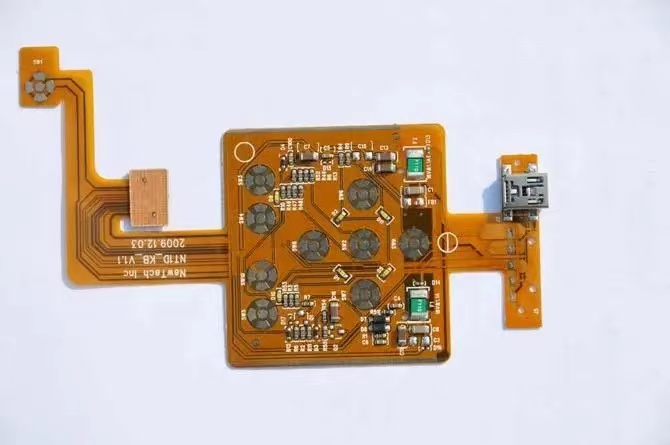

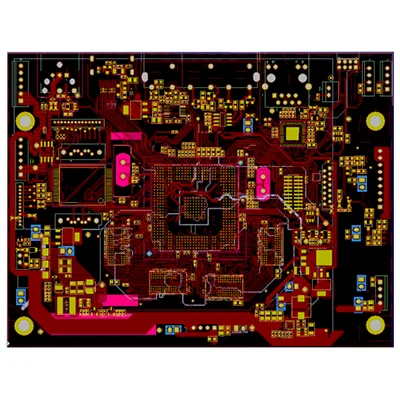

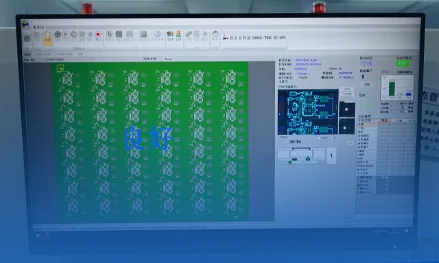

We have newly imported Yamaha high-end equipment, which can realize standardized production from solder paste printing,

SPI testing, reflow soldering and other links, which can improve production efficiency. Warehousing - Express" standardized process.

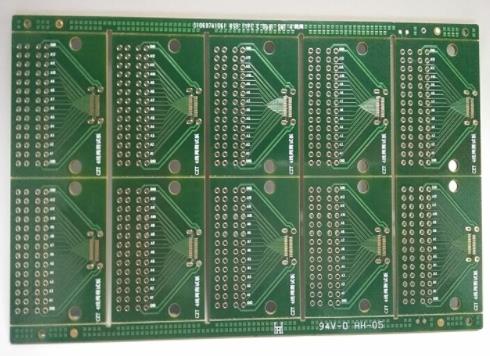

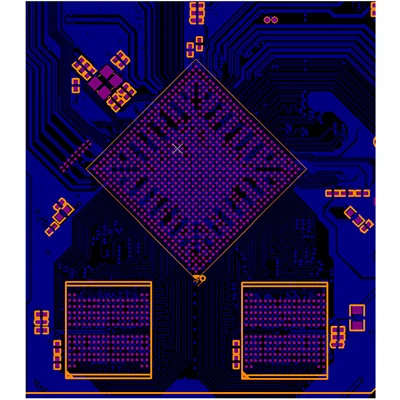

Point material storage

Loader

Solder Paste Printing

SPI

Surface mount

Nitrogen reflow soldering

First article inspection

DIP

QA detection

Three anti-coating

Package