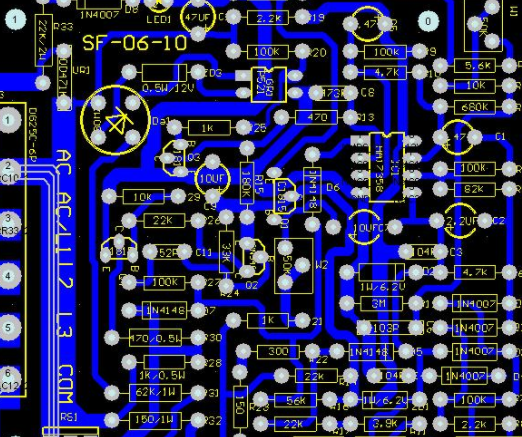

By the end of 2020, 5G PCB orders were dominated by base station construction, dominated by network information operators, and PCB orders were concentrated in leading enterprises. In the next step, the consumer electronics industry chain can be deployed in advance. For example, since the second half of 2020, the three major operators in China have been pushing 5G packages in a unified way, encouraging users to change 5G packages nationwide (especially in the sinking market) through such selling points as "increasing network speed, lowering charges, and full coverage", and the attention of 5G mobile phones has increased unprecedentedly. At the same time, with the help of "home economy", 5G entertainment related electronic products are expected to be further boosted,

In 2020, the PCB industry will continue to grow in a favorable market driven way due to domestic and foreign troubles. The most striking one is undoubtedly 5G communication. The relevant application fields have brought "big orders" to the leading PCB manufacturers.

By the end of 2020, 5G PCB orders were dominated by base station construction, dominated by network information operators, and PCB orders were concentrated in leading enterprises. In the next step, the consumer electronics industry chain can be deployed in advance. For example, since the second half of 2020, the three major operators in China have been pushing 5G packages in a unified way, encouraging users to change 5G packages nationwide (especially in the sinking market) through such selling points as "increasing network speed, lowering charges, and full coverage", and the attention of 5G mobile phones has increased unprecedentedly. At the same time, with the help of the "home economy", 5G entertainment related electronic products are expected to be further boosted, such as home game consoles, mobile game consoles, smart glasses, VR devices, etc., which can bring considerable orders to the PCB industry.

However, the key to the business opportunities of 5G communication for PCB lies in how to turn the potential demand into a practical application. This requires PCB enterprises to deeply understand the changing needs of terminals and propose a comprehensive solution based on the strength of materials and equipment. Therefore, 5G opportunities need PCB upstream and downstream collaborative layout to break through.

PCB trend in 2021: warmer demand, active production expansion, Chinese market

Looking forward to 2021, the COVID-19 epidemic is still unclear, and the world is waiting for a big turnaround in vaccination. International trade disputes entered a short truce at the beginning of the year, and the global economy also showed signs of bottoming out. This is a rare opportunity for all walks of life, and also a preparation period for building a defense line.

As the mother of electronics, PCB industry has a faster chance of recovery than other electronic industries. Since the end of the epidemic is "a hundred wastes waiting to be revived", terminal demand will surge rapidly, and "active production expansion" is expected to become the key word for post epidemic PCB manufacturers.

Market segment demand:

The global 5G infrastructure brings about the "first shot" of PCB expansion. 2020 is the big year of 5G infrastructure construction, and only 600000 base stations will be opened in China throughout the year; This figure will still grow by 30% in 2021, or reach 8-1 million seats. At the beginning of 2021, Japanese PCB manufacturers said that "the capacity of a single 5G enterprise has reached full capacity", so the demand for 5G communication boards will still rise.

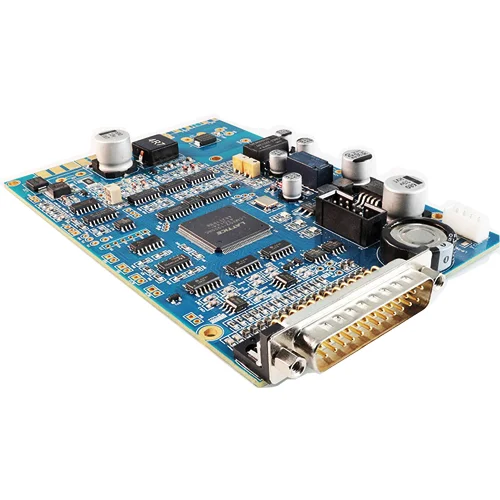

Consumer electronics show a trend of high density. HDI faces the downstream terminal market and is expected to be one of the fastest growing tracks in PCB applications. In 2021, domestic PCB manufacturers will accelerate the HDI product layout and focus on the first and second level production capacity, mainly targeting mobile ODM manufacturers such as Wentai and Huaqin; It still takes time to introduce high-end products, and high-end capacity above the third level and Anylayer is in short supply.

The other new battlefield is high and multi tier, including high and multi tier, servers, storage, wired wireless base stations, etc., with an annual compound growth rate of more than 5%. At present, Taiwan based PCB manufacturers have a leading edge in technology, while Chinese domestic PCB manufacturers (including Hong Kong funded ones) have huge domestic demand support, so the development prospects of both are promising.

Finally, the miniLED backplane is also an application field worth paying attention to, because there are not many such boards, up to three layers at most, which is basically not difficult. The industry can cut in from the perspective of new applications to cater to the hot spots of market consumption, so as to obtain appropriate orders.

For the above, domestic PCB manufacturers in China have added new capacity. It is observed that in 2020, domestic manufacturers will fill the capacity previously opened in 2018-2019; In 2021, the past capacity planning is basically further implemented to meet new orders and new markets.

From the output value data, the overall situation of global PCB is moving forward under pressure. Among the top 100 PCB companies in the world, there are 120 PCB companies with global output value of more than 100 million dollars in 2019. Only 49 enterprises had negative growth, accounting for 40.2%, with the largest decline of - 29.76%; Most of the 60% of the enterprises are growing positively, with the highest growth reaching 100%. It can be seen that the overall situation is still optimistic.

However, according to the enterprises and output value of different countries/regions, the number, total output value and proportion of output value of Chinese domestic enterprises (including Hong Kong) in the list have reached a new historical high. The number of enterprises in the list has reached 50, with a total output value of 16.683 billion, accounting for 26.8% of the total output value of the global top 100 list. In the following order, Taiwan, China (25, 2.1152 billion), Japan (18, 11.229 billion), South Korea (12, 7.125 billion), the United States (3, 3.109 billion), Europe (5, 1.725 billion), Southeast Asia (4, 1.058 billion).

It is easy to see that China's PCB industry has a unique landscape. First, the global PCB industry is basically transferred to China (including Hong Kong and Taiwan), and the next destination (Southeast Asia) has not been formed yet. Therefore, no matter the market trend is good or bad, more than half of the world's PCBs will be manufactured in China, which will promote the further expansion of China's PCB industry. The second reason is that Chinese local manufacturers already have "hard power". Low process process single-layer boards and double-layer boards can reduce costs and increase efficiency through automatic production. High process process HDI, IC carrier boards and 5G PCBs have all been won by leading enterprises. Chinese PCB products cover the full range of low, medium and high levels, and have a say in the industrial chain. They have mature guarantees such as quality and after-sales, and the supply chain is also quite stable. The third reason is that the localization boom has led to a strong long tail demand, and the sample and small batch PCB manufacturers have gradually expanded their profit margins. It is believed that the trend and opportunities of the global PCB industry in 2021 will still focus on the Chinese market.