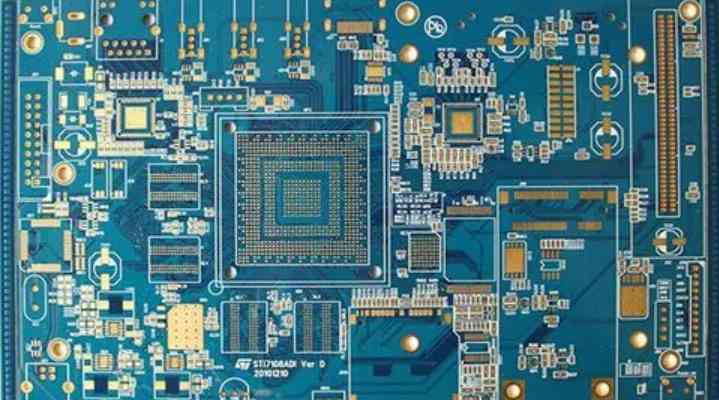

There are many types of printed circuit board products, which can be classified according to the substrate material, the number of conductive graphic layers, product performance, application field and other dimensions. According to the different structure of the substrate, the printed circuit board can be divided into rigid circuit board, flexible circuit board, soft and hard combined board and HDI board. With the development of electronic information industry, the downstream application fields of printed circuit board industry are becoming more and more diversified. The application fields involve various social and economic industries such as communication electronics, consumer electronics, computer, automotive electronics, industrial control, medical instruments, national defense and aerospace, etc. Therefore, the cyclical impact of PCB industry is less by a single downstream industry. Its periodicity is mainly reflected in the fluctuation of macro economy and the change of the overall development of the electronic information industry.

Globally, with the advantages of Asia, especially China, in labor, policy orientation, industrial clustering and other aspects, the center of gravity of the global PCB industry continues to shift to Asia, gradually forming a new pattern with Asia as the center and other regions as auxiliary. Asia, especially mainland China, has become the main production base of PCB and its high-end products HDI in the world. At present, domestic PCB manufacturers are mainly concentrated in the Pearl River Delta, Yangtze River Delta, Bohai Rim and other areas with high economic level. However, affected by cost and other factors, domestic PCB manufacturers are gradually moving to the mainland. At present, the main downstream applications of HDI industry are concentrated in the fields of mobile phones, tablets, laptops and other communication electronics and consumer electronics. In the field of consumer electronics, the production and sales scale of HDI manufacturers in the second half of the year is generally higher than that in the first half of the year due to the comprehensive influence of downstream customers' holiday consumption and consumption peak season.

Domestic market development status

The PCB industry is widely distributed in the world. Developed countries in Europe and the United States started early, developed and made full use of advanced technology and equipment, so the PCB industry has achieved considerable development. Since the end of 1990s, Asia, especially China, with its advantages in labor, resources, policies and industrial agglomeration, has continuously introduced foreign advanced technology and equipment and become the region with the fastest growth of PCB output value in the world. The PCB industry has gradually presented a new pattern with Asia, especially mainland China, as the manufacturing center. Mainland China has become the fastest growing region for PCB output value and HDI of high-end products in the world. From the PCB industry development path, in recent years, the global PCB industry has experienced three industrial transfer process. The first transfer was from Europe and the United States to Japan, the second was from Japan to Korea and Taiwan, and the third was from Korea and Taiwan to the Chinese mainland.

The PCB product structure is continuously optimized, and the HDI market is developing strongly. According to public data, in 2020, among many PCB products in mainland China, multilayer board is the product with the largest output value, accounting for 44.86% of the output value. The market share of HDI board and flexible board increased rapidly, accounting for 17.34% and 17.37% of the output value respectively. With the development of PCB application market towards intelligent, thin and high precision direction, the proportion of high technology content, high value-added HDI board, flexible board and packaging substrate in the PCB industry will further increase, the development of downstream demand will continue to promote the optimization of the PCB market structure, promote its rapid renewal development.

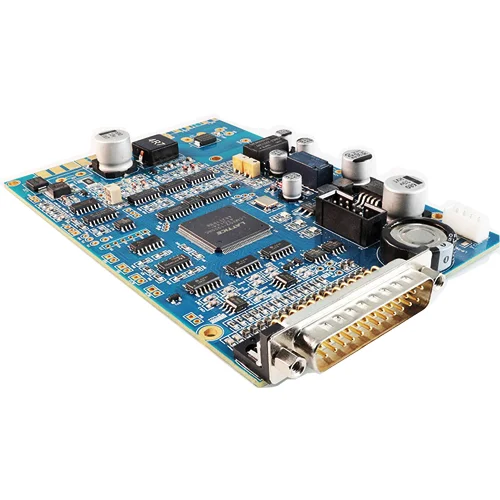

5G infrastructure construction began rapidly in 2019, and by the end of 2019, China had built more than 100,000 5G base stations. In the 5G era, the upgrading of smart phones, the rise of the Internet of things, and the improvement of the complexity of automotive electronics and a series of downstream industries will change and upgrade, so that the RF line will occupy more space in 5G mobile phones, the mobile phone motherboard and other components will be compressed to a higher density, and the packaging will be smaller and more complex, promoting the HDI to become thinner, smaller and more complex. In addition to smartphones, other consumer electronics, Internet of Things applications will also drive the rapid growth of high level HDI and soft and hard board demand.

The current trend of the overall consumer electronics is to high intelligence, thin and portable direction of development, this development trend for PCB products in consumer electronics requirements continue to improve. According to public data, the largest proportion of PCB products in mobile terminals is HDI board, which accounts for more than 40%. At present, China vigorously promotes 5G mobile phones, computers and other consumer electronic products. It can be predicted that in the future, high-level HDI products will develop rapidly and continuously improve the proportion. The trend of higher integration, lighter and less space for components in mobile terminals will also further promote the upgrade and development of HDI boards and soft and hard combined boards.

The market for PCB downstream applications in mainland China is widely distributed, generating continued impetus

The development of downstream industry is the driving force of PCB industry growth. At present, the downstream application market of PCB in mainland China mainly includes communication, consumer electronics, computer, network equipment, industrial control, medical, automotive electronics, aerospace and other fields. As one of the most powerful branches in PCB market, the application of HDI board in the downstream market continues to deepen. At present, HDI products are mainly used in mobile phones, laptops, automotive electronics and other digital products, among which mobile phones are the most widely used. In recent years, the development momentum of the combination of soft and hard board is also a good trend, high integration and flexability determines the high applicability of the combination of soft and hard board, which can be applied to all kinds of products, large and small. At present, more applications are still small consumer electronic products, such as mobile phones, headphones, cameras and other products.

With the official issuance of 5G commercial licenses, 5G construction has entered a stage of high-speed development, and the future market demand for communication multilayer boards and high-frequency high-speed boards is huge. At the same time, China is vigorously promoting the Internet development strategy, new technologies and products continue to emerge, cloud computing big data and other emerging technologies continue to innovate, AI equipment, autonomous driving and other new generation of intelligent products continue to develop, which will greatly stimulate the rapid development of consumer electronics, automotive electronics and other PCB application market, 5G mobile phone promotion also promotes the update and upgrade of HDI board. Promoted the rapid development of the HDI market.

The HDI market in mainland China is in short supply, and domestic manufacturers usher in development opportunities

Since 2019, the government has vigorously supported the construction of 5G base stations, and the number of base stations is greater than in the 4G era. Massive construction of data centers, 5G and AI will increase the demand for high-end printed circuit board. While the automotive sector has temporarily slowed down this year due to the pandemic, autonomous driving, V2X communications and automotive electronics will quickly boost demand for automotive electronic PCBS. In terms of consumer electronics, due to the higher degree of chip integration in 5G mobile phones than 4G mobile phones, the ordinary HDI of traditional Android mobile phones will be upgraded to high-end HDI, such as third-tier, fourth-tier, or arbitrary HDI. The upgrade of HDI combined with the recovery of consumer electronics shipments will become the driving force for the continuous improvement of PCB proportion for consumer electronics. The demand trend of mobile terminals for higher integration, lighter, and more space saving has promoted the upgrading of motherboard HDI in mobile phones. 5G consumer electronics, communications, and automotive electronics have driven the growth of demand for high-level HDI.

However, the supply growth of the domestic high-level HDI market is slow. On the one hand, due to the financial and technical barriers of new entrants, the HDI production line requires a large amount of capital investment such as the purchase of equipment, as well as the long-term accumulation of technology, so the entry cost of new manufacturers is relatively high, and the number of manufacturers is difficult to increase significantly in the short term. On the other hand, for existing PCB manufacturers, level upgrading needs to consume more capacity. For the original production capacity of low-order multi-layer HDI, the final output will be greatly reduced if the production capacity of high-order multi-layer HDI is to be produced. As 5G construction enters the stage of rapid development, the future market demand for communication multilayer board and high-frequency high-speed board is huge. Although some manufacturers have invested in production expansion, overall, the capacity growth of domestic HDI still cannot meet the rapid growth of demand. In this case, there will be an imbalance between supply and demand in the domestic high level HDI market in recent years. Therefore, the current domestic high level HDI manufacturers will usher in huge development opportunities.